How Much To Charge For Notary Services In Nj

Notaries oft ask if they tin charge signers an additional travel fee during mobile Notary assignments. The answer is that each land is dissimilar: Some say aye and fix travel fees; some allow it and only provide broad guidelines for the fee, and others provide no guidance at all.

This article offers Notaries a guide to each state's Notary travel fee rules and guidelines, grouped into 5 general categories. We'll wait at how travel fees piece of work for states in each category and provide yous with helpful tips. The categories are:

- States that ready travel fees

- States that base travel fees on federal or country mileage rates

- States with full general travel fee guidelines

- States that allow Notaries to set their own travel fees

- States that prohibit charging travel fees

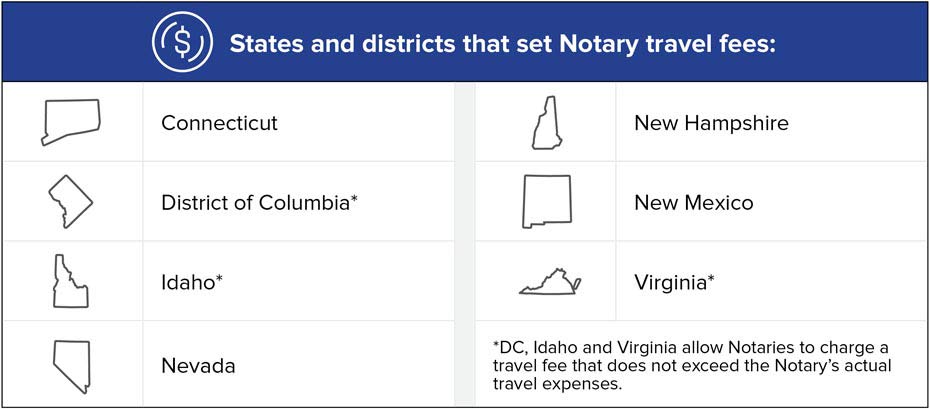

States that set travel fees

There are six states and the District of Columbia that set the fees Notaries may accuse to travel: Connecticut, Idaho, Nevada, New Hampshire, New Mexico, and Virginia. In these states, the maximum corporeality for travel is prepare by country constabulary.

Connecticut and New Hampshire are the most straightforward. Connecticut allows Notaries to charge 35 cents per mile for travel, and New Hampshire 20 cents per mile, but the rate merely applies when a Notary travels to swear witnesses for a deposition (RSA 455:11; 517:xix).

Though the District of Columbia, Idaho, and Virginia exercise not set up an actual fee, their laws only allow Notaries to charge the actual and reasonable expense of travel (CDC one-1231.23[b], IC 51-133[2], and COV 47.i-xix[D]). For example, if a Notary in one of these jurisdictions spent $five total on fuel or other travel expenses while traveling to a notarization, the Notary cannot charge the signer more than than that amount for a travel fee.

New Mexico sets a travel fee of xxx cents per mile, just also requires Notaries to inform their customers in advance that the fee will utilize; that travel fee is in addition to the notarization fee, and that the Notary is not required past law to charge the travel fee. Constructive January 1, 2022, the 30 cents per mile maximum fee will be repealed and Notaries volition be able to set their ain travel fee.

Nevada's laws are the almost unique, specific, and complicated. The Notary and signer must agree on the hourly rate of travel in advance. The Notary must explain that the travel fee is separate from notarization fee and not required by law. These requirements mirror requirements of other states and are clear and piece of cake to understand.

However, the maximum hourly rate is where things get more complicated. Nevada Notaries may not charge more than the following hourly rates, and the charge per unit depends on the time of twenty-four hours they travel:

- The travel fee may not exceed $15 for travel betwixt 6 a.m. and 7 p.m. ($10 per 60 minutes for an electronic notarization) or $30 per hour for travel between 7 p.chiliad. and 6 a.chiliad. ($25 per hour for an electronic notarization).

- Notaries may charge a minimum of ii hours for such travel and must charge on a pro rata basis after the first two hours (NRS 240.100[3][d]).

Nevada police besides prescribes the post-obit rules related to charging travel fees:

- Travel fees must be recorded in the journal, along with the date and fourth dimension Notary began and concluded the travel (NRS 240.100[5]).

- The Notary may demand that the travel fee be payable in advance (NRS 240.100[2]).

- The Notary is entitled to the additional travel fee if the person requesting the notarial act cancels the request later on the Notary begins to travel, or the Notary is unable to perform the notarial act as a result of the deportment of the person who requested it or whatever other person who is necessary for the performance of the notarial act (NRS 240.100[4]).

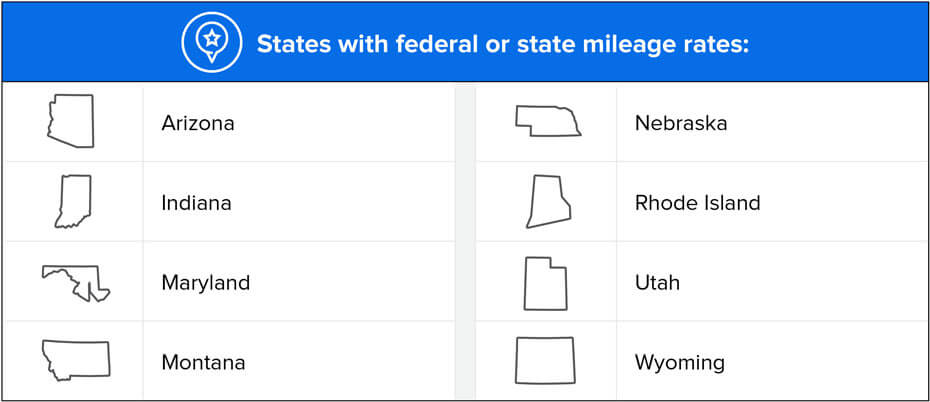

States that base travel fees on federal or state mileage rates

8 states base of operations the travel fee on mileage rates set by state or federal agencies. Dissimilar states that set their ain fees, these mileage rates can change from year to year when the rate for travel increases or decreases. Notaries in these states should ever confirm the current authorized mileage rate before charging a travel fee.

In Arizona and Nebraska, travel fees are based on state mileage rates. For the latest authorized mileage rate in Arizona, bank check the fee schedule online. The Nebraska mileage charge per unit, which applies only to serving notices of protest and not to other notarial acts, is set past the Country Department of Administrative Services (433 NAC 6.008.04[F]), which according to country Notary officials is currently 51 cents per mile.

Indiana, Maryland, Montana, Rhode Island, Utah and Wyoming allow Notaries to accuse federal mileage rates.

In Indiana, the travel fee "may not exceed the federal travel fees established by the United states of america General Services Administration" (IC 33-42-fourteen-ane[e]). Maryland indexes the travel fee to the Internal Revenue Service per mile rate for business travel plus an additional $five (ACM St. Gov't 18-107[b][ane]) (COMAR 01.02.08.02D). Montana, Rhode Island, and Wyoming also set their travel fee to the Internal Revenue Service per mile rate. Utah is the least specific, stating it must be set at the "federal mileage rate" (UCA 46-1-12[2]).

Montana, Utah and Wyoming likewise require Notaries to inform customers well-nigh travel fees in advance and clarify they are split from the regular notarization fee.

States with travel fee guidelines

13 states do non set the amount of travel fees only provide full general guidelines for Notaries to follow when charging a travel fee. These states are: Arkansas, California, Georgia, Michigan, Minnesota, Mississippi, Missouri, North Dakota, Ohio, Oregon, Pennsylvania, South Carolina and Washington.

In these states, the corporeality of a travel fee is non specified, merely Notaries must follow any guidelines issued by the state. These guidelines commonly are published in country Notary handbooks or online. For example, near of these states (California and Minnesota are exceptions) require the travel fee to be agreed upon with the signer prior to travel. Arkansas Notaries are required to disclose any fee they charge (including a travel fee) with the signer prior to travel commencing. The Minnesota Department of Commerce has posted an informational that Notaries who charge travel fees may be required to obtain a existent manor closing license. In California, the Secretarial assistant of Land has said, "Other fees, such equally travel fees and/or loan signing fees should not be included as fees charged for the notarial service. You may note other fees charged in the additional information portion of your journal" (Notary News, 2020). Pennsylvania Notaries may charge customary and reasonable "clerical or administrative fees" for notarizations, including travel, according to the Pennsylvania Section of State website. Notaries should inform customers of the fee in advance and note the fee separately in their journal.

Mississippi, Missouri, North Dakota, Oregon, South Carolina, and Washington also crave Notaries to inform the signer that the travel fee is not mandated by law.

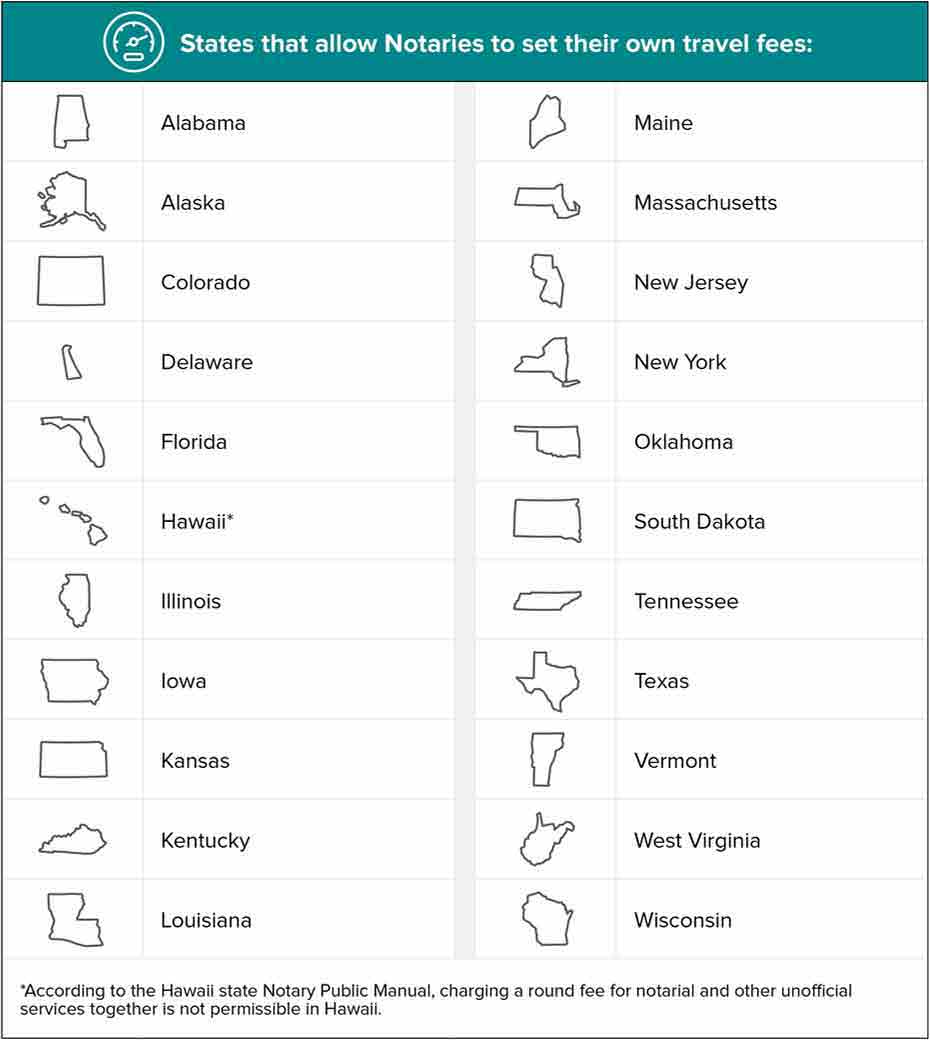

States that allow Notaries to ready their own travel fees

The following states let Notaries to set their own travel fees or practise not regulate Notary or travel fees:

The following states let Notaries to set their own travel fees or practise not regulate Notary or travel fees:

- Alabama

- Alaska

- Colorado

- Delaware

- Florida

- Hawaii

- Illinois

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- New Jersey

- New York

- Oklahoma

- Southward Dakota

- Tennessee

- Texas

- Vermont

- Westward Virginia

- Wisconsin

Many of these states recommend that Notaries set "reasonable" fees.

If your state does not provide travel fee rules or guidance, the NNA suggests the post-obit 5 best practices:

- Go along travel fees separate for notarial fees.

- Inform the customer on the travel fee in advance.

- Explicate your travel fee payment policy should the notarization not be completed.

- Request travel fee payment in accelerate (optional).

- Tape the travel fee separately from the notarization fee in your journal.

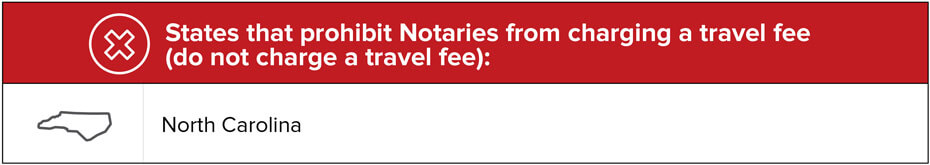

Where travel fees are prohibited

Only 1 state — North Carolina — specifically prohibits its Notaries from charging travel fees: "Notaries are not authorized to charge travel or mileage expenses to their clients" (NPG). Doing and then could result in the Notary being disciplined past the division director for the N Carolina Department of the Secretary of Land Notary Public Department (18 NCAC 07B .0904).

Source: https://www.nationalnotary.org/notary-bulletin/blog/2021/07/notary-travel-fees-across-united-states

Posted by: johnsonprowell.blogspot.com

0 Response to "How Much To Charge For Notary Services In Nj"

Post a Comment